‘Hidden Debts’ to China Raise Financial Risks for African Borrowers

ADF STAFF

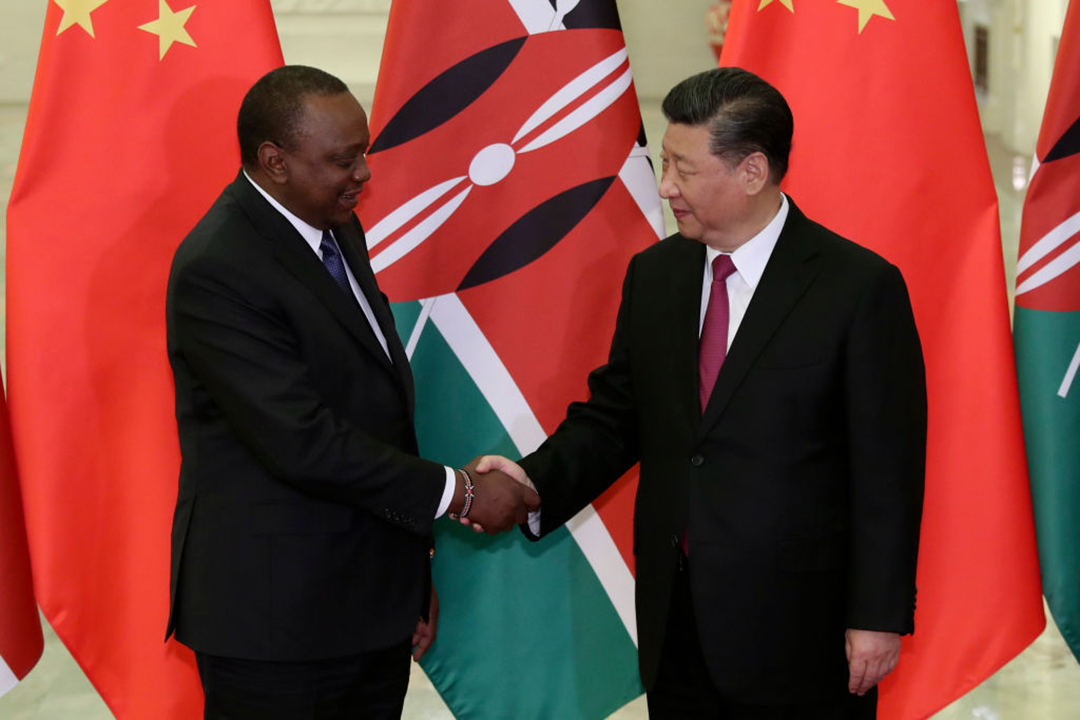

Through its Belt and Road Initiative (BRI), China has loaned billions of dollars to African nations for a variety of major infrastructure projects, from highways and ports to power plants and government buildings.

Although countries such as Angola, Kenya and Mozambique have acknowledged much of their debt to Chinese lenders, a new study by the AidData project has revealed that countries across the continent are responsible for billions more in “hidden debt” — debt issued to private entities or state-operated enterprises for which national governments also are responsible in the event of a default.

Globally, the scale of hidden debt is substantially larger than financial institutions or governmental organizations previously understood, according to the report “Banking on the Belt and Road.”

In Africa, the report estimates, at least four countries — Angola, the Democratic Republic of the Congo, Mozambique and Namibia — have hidden debts to China higher than 10% of their gross domestic product.

The report examined China’s lending practices between 2000 and 2017, including 13,000 projects around the world tied to the BRI, which started in 2013. A key finding: With the launch of BRI, China shifted its lending sharply away from heavily indebted government loans in favor of loans to nongovernmental entities.

In most cases, those new loans carried much higher interest rates than government-to-government lending. They also were frequently tied to projects, such as ports and power stations, that expected to pay off their debts through their own revenue but often with government guarantees backing them up. This blurs the lines between private and public debts.

Such loans let governments develop infrastructure projects off their books, the report notes.

“The reason why this is a problem,” AidData Executive Director Brad Parks told ADF, “is because if and when these borrowing institutions outside the central government default on their repayment obligations, the central government may face significant pressure to bail them out and repay their unpaid debts to China.”

In Africa, a few such projects include Kenya’s Standard Gauge Railway, Zambia’s Zesco power station, and Ethiopia’s Addis Ababa light-rail system. All three projects have run into trouble repaying their loans because of lower-than-expected revenue or other problems.

AidData found that by 2017, China had loaned African countries $41.7 billion for development-related projects (such loans included the potential for up to 25% to be forgiven) but more than triple that — nearly $136 billion — in less-flexible commercial-oriented loans.

The biggest recipients of those commercial loans in Africa have been Angola ($40.65 billion), Ethiopia ($8.9 billion), Kenya ($7.02 billion), Nigeria ($6.82 billion) and Sudan ($7.55 billion).

Many of those loans have been issued using the projects they financed as collateral, creating the potential for China to take over key pieces of national infrastructure if the borrowers default on their payments.

The odds that China will take ownership of collateralized projects is low, however, Parks said.

“Typically, what they will do is require that their borrower maintain a minimum cash balance in an offshore bank account that is controlled by the lender,” he said.

That way, China gets paid in case of a default without having to take the borrower to court to recover the money that is due, he added.

With the global outbreak of COVID-19 in 2020, many nations suddenly found themselves caught between falling revenues, rising health care demands and looming loan payments. Renegotiating those commercial debts has proven difficult and time consuming in most cases. Some countries have sought help from the International Monetary Fund only to find their request stymied by confidentiality agreements tied to their hidden debt loans.

“Zambia is a case in point,” Parks said. “Some of its biggest private creditors are refusing to renegotiate its debt until they get more information about China’s claims and the terms of China’s debt restructuring.”

Parks said it’s important to remember that African countries have made their deals with China — and gotten mired in debt in the process — voluntarily.

“No one should labor under the false presumption that borrower institutions in developing countries have no agency or choice,” he said. “Countries do need to be careful about accumulating unsustainable amounts of debt to China.”

Comments are closed.