Pandemic Increases Mobile Banking in Africa

ADF STAFF

The emergence of COVID-19 has presented opportunities for companies in Africa to expand mobile banking services.

Mobile banking can help telecommunications companies and banks retain customers and cross-sell services, promote financial inclusion, and reduce the continent’s dependency on cash, François Jurd de Girancourt, head of financial practices in Africa at McKinsey & Company, a consulting firm, told ADF in an email.

In Kenya, Morocco and South Africa, cash accounts for 90% to 95% of all transactions, while the rate is as high as 99% in Nigeria, according to data provided by McKinsey.

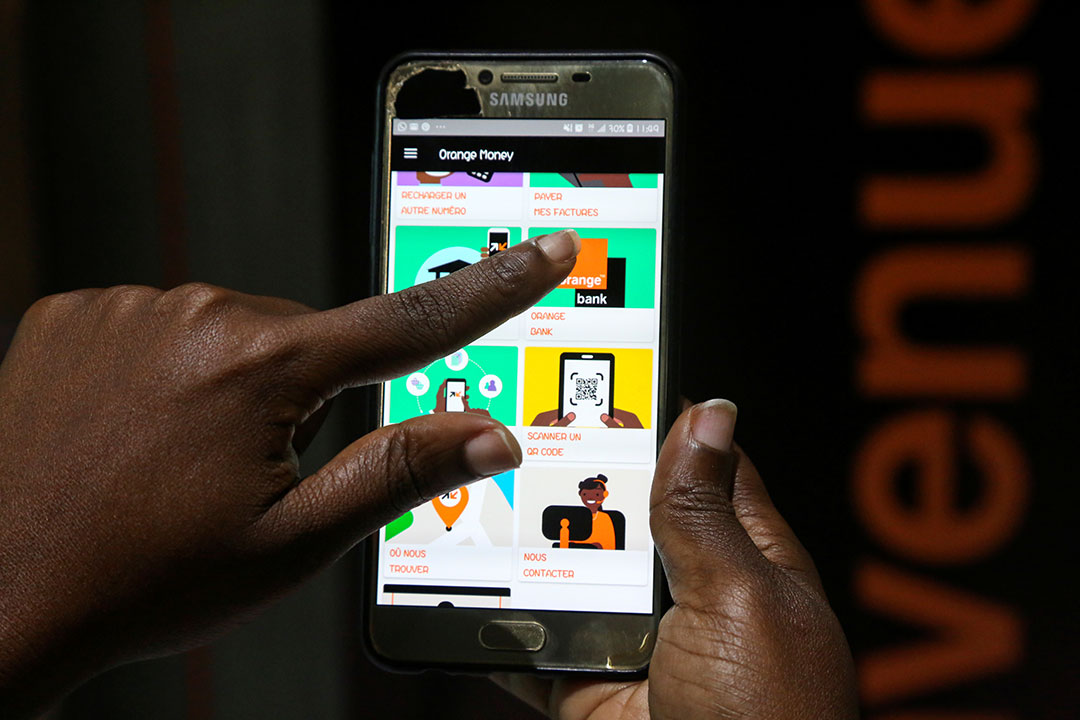

Mobile banking was growing even before COVID-19 hit because far more Africans have access to mobile phones than to traditional banks. Mobile finance revenues are approaching $3 billion per year for telecommunications companies in Africa, including Orange Money, Vodacom, Safaricom, MTN and Airtel, Jurd de Girancourt said.

“Mobile finance is a long-term trend, but the COVID crisis has opened opportunities to accelerate adoption [in Africa], for instance, by distributing social aid to citizens through mobile wallets, as in Togo,” Jurd de Girancourt said.

“Another example is payments — not transfers — via mobile. During the [pandemic], Morocco significantly simplified the process to enable merchants to accept mobile money payments. Typically, these merchants only accept physical cash today.”

In South Africa, the telecommunications company Telkom plans to introduce a “digital wallet” through a new app.

“It’s very clear that there is an opportunity to create an offering that can perhaps go a long way toward being a very good substitute for the need to carry cash around,” Sibusiso Ngwenya, managing executive at Telkom, said on a TechCentral podcast.

Telkom plans to introduce the app by March 2021. Ngwenya said the company hopes its expanded mobile banking options will lead to “a less cash-intensive South Africa.”

Besides increasing its mobile banking initiatives, Telkom also is lowering fees and expediting new lending services in Africa, as are Orange, Vodacom and MTN, Reuters reported.

France’s Orange, with a head office in Côte d’Ivoire, plans to introduce a new mobile banking app developed through collaboration with NSIA, an Ivoirian banker-insurer, according to Orange’s website. Patrick Roussel, an executive vice president with Orange, said in a news release that the company wants to expand the app into Burkina Faso, Mali and Senegal after it is approved in Côte d’Ivoire.

“Right from the first subscription, all steps can be done via a smartphone or USSD [Unstructured Supplementary Service Data],” Roussel said. “Everything is automated, and it only takes a few seconds to open an Orange Bank Africa account.”

By the end of the year, MTN, Africa’s leading telecommunications operator, aims to offer a mobile money app for use at small retailers in several African markets and is piloting an effort to digitize small businesses in South Africa, Reuters reported.

“We have developed a low-cost payment acceptance solution for small retailers, enabling customers with feature phones to make payments with their MoMo wallets by dialing a USSD code with a feature phone or by using the MoMo app for smartphone owners,” Serigne Dioum, who heads the company’s mobile financial services division, told TelecomLead.

South Africa’s Vodacom — and Safaricom, its Kenyan subsidiary — acquired the mobile money payment service M-Pesa during the pandemic’s initial stages in early April. M-Pesa had grown to be the continent’s largest payments platform with roughly 40 million users in the Democratic Republic of the Congo, Egypt, Ghana, Kenya, Lesotho, Mozambique and Tanzania, according to Forbes.

Vodacom has accelerated efforts to help customers open bank accounts and plans to expand lending, insurance and payment businesses to markets outside South Africa, Reuters reported.

Comments are closed.